Khalil breaks down domestic and global issues surrounding nuclear energy's primary fuel: uranium.

An illustration of a fuel assembly, which provides

Click here for a pdf of the paper

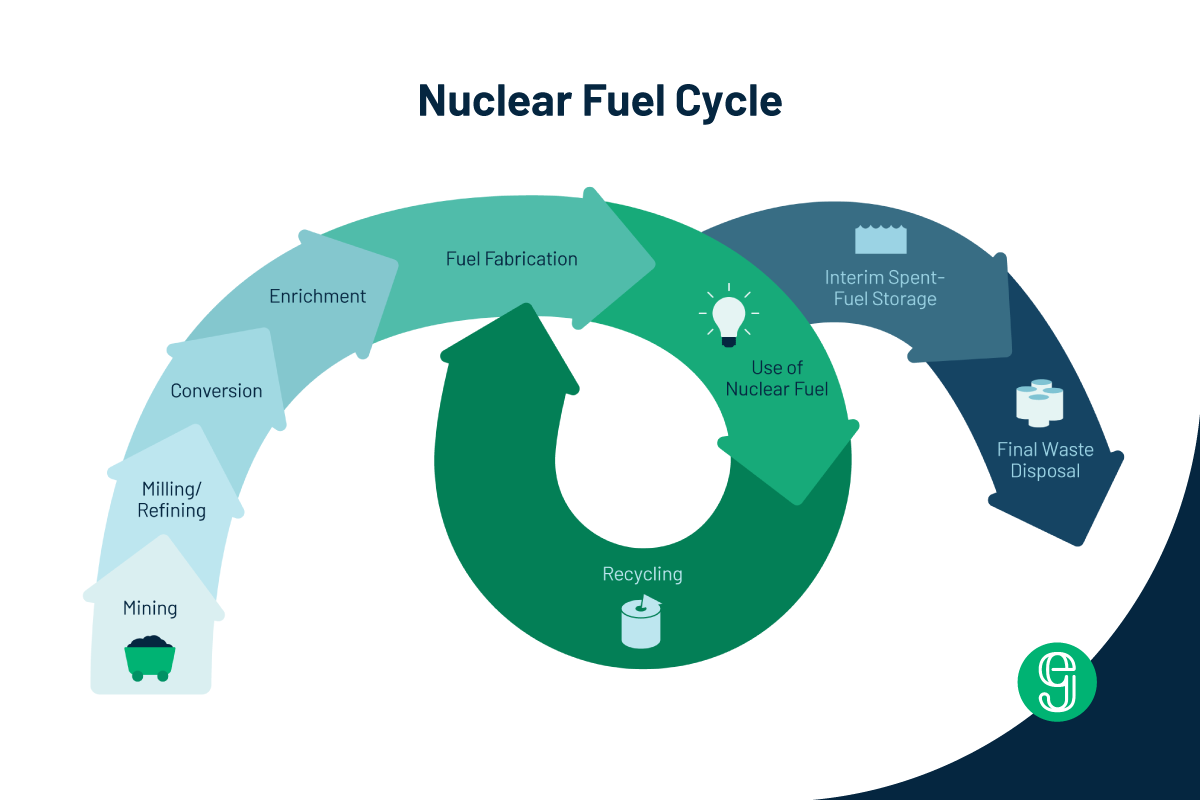

As demand for nuclear energy grows due to concerns over climate change and energy security, so will the demand for its primary fuel: uranium. On the positive side, uranium is exceptionally energy-dense, with nuclear power plants requiring refueling every few years. But unlike fossil fuels, uranium cannot simply be dug out of the ground and burned but must go through several processing steps, including milling, conversion, enrichment, and fuel fabrication. While the U.S. has the largest fleet of nuclear power reactors, it imports most of its nuclear fuel due to a long history of depressed global prices discouraging domestic production. Recent disruptions to the international markets for nuclear fuels have exacerbated concern over relying on nuclear power for energy independence.

Early weapons production in the U.S. relied on uranium secretly shipped from the Shinkolobwe Mine in the Belgian Congo. Following the end of WWII and the start of the Cold War, the U.S. government incentivized domestic uranium production, resulting in the U.S. leading global uranium production. Most U.S. uranium extraction occurred in the western United States on or near tribal lands. From 1960 to 1980, global uranium production grew by 53%. But as demand for nuclear energy stagnated following Three Mile Island in the U.S. and Chornobyl globally, uranium prices fell from $115/kg in early 1978 to $70/kg by 1981.

Over this period, consistently low prices reduced incentives to invest in new uranium mining, and the U.S. all but stopped producing its nuclear fuel. In 2021, the largest producers of uranium ore were Kazakhstan, Canada, and Namibia. Kazakhstan made 45% of global uranium in 2021, but most of that had to be enriched in Russia, as the country has close to half of the worldwide enrichment capacity.

Many countries that operate commercial nuclear power— including the U.S. — rely on Russia for some or all of their nuclear fuel. Even before the Russian invasion of Ukraine, western policymakers were concerned about the global nuclear industry's dependence on Russia for crucial aspects of the rest of the nuclear fuel cycle. This concern was especially poignant for former Soviet countries and others that operate Russian reactors like Finland.

There is also concern among the security community that this reliance on imported fuel may motivate nuclear newcomer countries to pursue domestic enrichment capabilities, which carry weapons proliferation risks. To help reduce this motivation, the International Atomic Energy Agency (IAEA) created the International LEU Bank to provide countries investing in nuclear power with a guaranteed fuel supply. A vital principle of the IAEA LEU Bank, as an assurance of supply mechanism of last resort, is that it must not distort the commercial market. The IAEA LEU Bank is used as a last resort, preventing it from interfering with average uranium sales and thus potentially interrupting the stability of the uranium market.

Due to these concerns about supply crunch and dependence on imports, the United States has sought to establish a Strategic Uranium Reserve to reduce reliance on foreign uranium imports. The Department of Energy aims to create a domestic uranium reserve to help support the domestic uranium mining and conversion industries until market conditions improve. Other nations, including the Czech Republic and Ukraine, have begun to make deals to purchase nuclear fuel from the American firm Westinghouse and France’s Framatome.

With advancements in nuclear technology, small modular reactors are becoming more accessible to nations lacking the capacity for standard nuclear reactors. The potential increase in demand from the growing number of countries seeking to transition away from fossil fuels could increase demand for civil nuclear power and, thus, require more uranium fuel. The current global supply chain of uranium will not be able to meet the increased demand. According to an estimate by one financial analyst, the increased demand for uranium could potentially lead to shortages and a price of ~$50 - 60 per pound (~$110-$130/kg).

Diversifying the nuclear fuel supply chain is crucial for ensuring the equitable and sustainable growth of nuclear energy. Governments and industry should focus on implementing policy changes that prioritize the diversification and strengthening of domestic uranium industries, while also guaranteeing the availability of affordable uranium and enrichment services for allied nations and nuclear newcomer countries. Ensuring that the global nuclear fuel supply is secure and diversified will enable democratic governments to include expansion of nuclear energy in their long-term clean energy goals.

Sources

Alvarez, R. (n.d.). Uranium mining and the U.S. Nuclear Weapons Program. Federation Of American Scientists. Retrieved November 15, 2022, from https://fas.org/pir-pubs/uranium-mining-u-s-nuclear-weapons-program-3/

Bhutada, G. (2021, September 23). 70 years of global uranium production by country. MINING.COM. Retrieved October 11, 2022, from https://www.mining.com/web/70-years-of-global-uranium-production-by-country/

Castillo-Peters, D., & von-Hippel, F. (2022, August 5). US and EU imports of Russian uranium and enrichment services could stop. here's how. Bulletin of the Atomic Scientists. Retrieved October 12, 2022, from https://thebulletin.org/2022/08/us-and-eu-imports-of-russian-uranium-and-enrichment-services-could-stop/

Gould, A. (n.d.). State of play: The legacy of uranium mining on U.S. tribal lands. Good Energy Collective. Retrieved from https://www.goodenergycollective.org/policy/the-legacy-of-uranium-mining-on-us-tribal-lands

Hansen, M. V. (1981). World Uranium Resources. International Atomic Energy Agency Bulletin, 23(2), 10–14. https://www.iaea.org/sites/default/files/publications/magazines/bulletin/bull23-2/23204891014.pdf

https://www.iaea.org/topics/iaea-low-enriched-uranium-bank

https://www.gao.gov/products/gao-21-28

Gwin, C. (2017, August 21). IAEA Low Enriched Uranium Bank launches in Kazakhstan, significant milestone for NTI-backed nuclear security initiative. The Nuclear Threat Initiative. Retrieved from https://www.nti.org/news/iaea-low-enriched-uranium-bank-launches-kazakhstan-significant-milestone-nti-backed-nuclear-security-initiative/

Lovering, J.R. and H. Halland. “Russia’s Nuclear Power Hegemony.” Foreign Affairs. June 8, 2022 https://www.foreignaffairs.com/articles/russian-federation/2022-06-08/russias-nuclear-power-hegemony

Moore, D. (2022, March 11). Russian uranium dominance leaves U.S. scrambling to catch up. Bloomberg Law. Retrieved November 30, 2022, from https://news.bloomberglaw.com/environment-and-energy/russian-uranium-dominance-leaves-u-s-scrambling-to-catch-up

The Economist Newspaper. (2022, January 15). The Kazakh crisis is only one threat hanging over the uranium market. The Economist. Retrieved August 30, 2022, from https://www.economist.com/finance-and-economics/2022/01/15/the-kazakh-crisis-is-only-one-threat-hanging-over-the-uranium-market

U.S. Energy Information Administration - EIA - independent statistics and analysis. The nuclear fuel cycle - U.S. Energy Information Administration (EIA). (n.d.). Retrieved October 7, 2022, from https://www.eia.gov/energyexplained/nuclear/the-nuclear-fuel-cycle.php

.png)

.png)

%252520(1200%252520%2525C3%252597%252520800%252520px).png)